Profitability is Not a Reporting Problem. It’s a Control Problem.

Profitability Is Not a Reporting Problem. It’s a Control Problem.

CFOs don’t lose margin because revenue drops. They lose it because cost, pricing, and performance are invisible until it’s too late.

We make profitability measurable, controllable, and defensible at board level.

The CFO Reality

The Finance function are expected to explain margin variance with lagging data, partial truth, and disconnected systems.

Typical issues we see:

- Margin erosion discovered after the close

- Cost-to-serve guessed, not known

- Incentives and rebates distorting profit

- Forecasts that do not survive contact with reality

- Board questions answered with narratives instead of numbers

This is not a finance capability issue.

It is a data, process, and operating model failure.

And it is fixable.

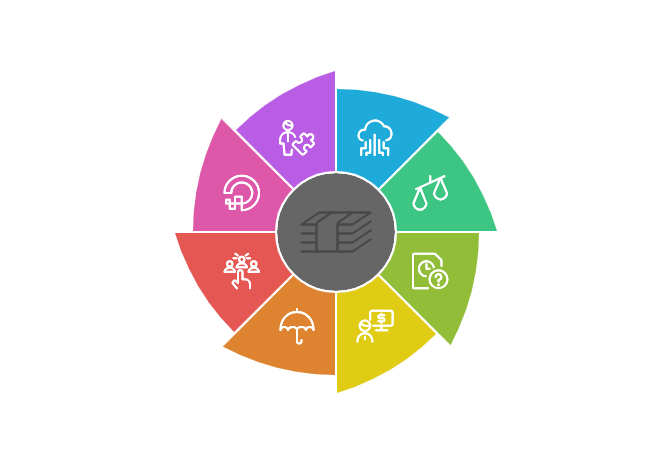

Common CFO Challenges

CFOs of global or large organisations encounter several challenges related to data management, reporting, and profitability. Key challenges include:

1. Data Complexity and Integration

Data Silos and Inconsistent Standards: Financial data is often scattered across multiple systems and regions, making it difficult to consolidate and analyse. Gartner underscores the importance of CFOs proactively leveraging data and analytics trends to overcome these challenges. (gartner.com)

2. Regulatory and Compliance Challenges

Navigating Diverse Standards: Managing different accounting standards and tax regulations across countries creates complexity in financial reporting. EY highlights the growing need to align ESG reporting with traditional financial reporting to meet evolving global regulatory requirements. (ey.com)

3. Accurate and Timely Reporting

Demand for Real-Time Insights: The increasing need for real-time reporting requires robust data management systems. Deloitte notes that CFOs must rethink their data strategies to address challenges in cost management and financial performance. (www2.deloitte.com)

4. Profitability Analysis and Performance Management

Understanding True Profitability: Assessing profitability across customers, products, regions, and channels is intricate. McKinsey’s research shows CFOs are adopting both defensive and growth strategies to build resilience and improve performance. (mckinsey.com)

5. Risk Management and Uncertainty

Economic Volatility: Factors such as currency fluctuations and inflation significantly impact profitability. Deloitte’s CFO Signals survey reveals that CFOs prioritise cost management and require data-driven approaches to navigate these uncertainties. (www2.deloitte.com)

6. Talent and Skills Shortage

Skill Gaps in Data Analytics: A lack of skilled accounting professionals leads to weak financial-reporting controls and higher turnover rates among CFOs. The Wall Street Journal reports that over 640 U.S.-listed companies cited insufficient accounting staff as a source of material weaknesses. (wsj.com)

7. Technology and Innovation

Adopting Advanced Tools: Implementing advanced analytics and AI requires significant investment and careful planning. Finance leaders are exploring the ROI of generative AI, balancing its transformative potential with its costs, as highlighted by the Wall Street Journal. (wsj.com)

8. Strategic and Business Alignment

Connecting Financial and Operational Data: CFOs are tasked with providing actionable insights to guide strategic business decisions. McKinsey notes that this requires a delicate balance between managing financial risks and identifying growth opportunities. (mckinsey.com)

Why Do You Need the Profitability Accelerator When You Already Have a Profitability Model?

Traditional financial reporting systems provide a view of profitability, but they often fall short of delivering the unified, enterprise-wide insights required for today’s complex business challenges. The Profitability Accelerator goes beyond a static profitability view by building a foundational data layer that creates a single, integrated source for all financial and operational data across your enterprise. What Makes the Profitability Accelerator Different?

Enterprise Data Strategy for Finance

We eliminate data silos by integrating financial and operational data, ensuring consistency across the organisation.

Technology-Agnostic Solution

Our solution works seamlessly with your existing systems, providing flexibility and adaptability to your unique needs.

Customisable and Governed

We design and customise foundational elements of your profit and loss statements and related metrics while implementing strong data governance to standardise and simplify data lineage.

Consistent and Accessible Insights

Gain a unified, trusted view of financial performance for reporting and analysis, accessible to all approved users across the enterprise.

We work with CFOs to:

1

Expose true margin by product, customer, and channel.

What We Do for CFOs

2

Quantify cost-to-serve at a level the board trusts

What We Do for CFOs

3

Identify structural margin leakage, not symptoms

What We Do for CFOs

4

Replace manual reconciliation with controlled automation

What We Do for CFOs

5

Create board-ready metrics that stand up under scrutiny

What We Do for CFOs

Biography

Matt is a seasoned transformation leader and strategic advisor with a career rooted in turning data, digital, and technology investment into measurable business value. He brings deep experience working within complex, global organisations, where strategy, governance, and execution must align to deliver outcomes at scale.

During his career at BP, Matt led and contributed to multiple enterprise-wide transformation initiatives, operating at the intersection of business strategy, data, and technology. Most notably, as Chief Data Officer for Castrol, he designed and embedded a global data and analytics strategy spanning more than 80 countries. His work focused on strengthening data governance, modernising analytics capability, and enabling operational and commercial decision-making, delivering tangible financial and performance benefits across the organisation.

In 2019, Matt founded Data Value Creation Ltd, now operating under the OMNIADIGITAL.AI brand. Through this work, he advises businesses and charities on how to design and execute pragmatic digital, data, and AI transformations that are anchored in real business priorities. His approach centres on aligning technology initiatives to strategic goals, accelerating time to value, and ensuring investments result in sustainable capability rather than short-lived solutions.

Matt’s leadership style is defined by clarity of purpose and a relentless focus on outcomes. He is experienced in shaping strategic agendas, engaging senior stakeholders, and navigating governance, risk, and organisational complexity to deliver change that lasts. He is particularly focused on helping organisations avoid common transformation pitfalls by grounding ambition in execution discipline and value realisation.

He remains passionate about enabling organisations and charities to navigate today’s fast-moving landscape through thoughtful, data-driven transformation, using technology not as an end in itself, but as a catalyst for better decisions, improved performance, and long-term value creation.

Biography

Lucy Lynch is a Fractional Chief of Staff at Omniadigital, working closely with leadership teams to ensure strategy, delivery, and execution remain tightly aligned. She operates at the intersection of planning and action, helping organisations focus on what matters most and translating intent into coordinated, high-impact outcomes.

In her role, Lucy partners directly with the CEO to drive strategic transformation initiatives aligned to long-term business objectives. She plays a central role in orchestrating delivery across projects, accounts, and stakeholders, ensuring momentum is maintained and priorities are executed effectively as the organisation grows.

Lucy also leads on brand development and market positioning, strengthening Omniadigital’s visibility and competitive edge through clear messaging and purposeful engagement. Alongside this, she is instrumental in building and nurturing a data-led community, creating curated events, roundtables, and thought-leadership forums that connect practitioners, leaders, and partners around shared challenges and opportunities.

A key part of Lucy’s work involves leveraging academic and research partnerships to help deliver future-ready, evidence-based solutions tailored to client needs. This ensures that innovation is grounded in insight, rigour, and real-world applicability.

Lucy thrives where strategy, people, and possibility meet. She brings clarity, structure, and energy to complex environments, helping organisations remain aligned, agile, and prepared for what’s next.

Biography

Tina Salvage is an accomplished data and AI leader with over a decade of experience shaping data strategy, governance, and capability across complex, global organisations. Her work sits at the intersection of regulatory rigour, commercial value, and responsible innovation, helping organisations unlock the full potential of data while managing risk at scale.

Throughout her career, Tina has led enterprise-wide initiatives spanning federated operating models, data product prioritisation, and large-scale data literacy programmes. She has a strong track record of transforming data and AI capabilities into practical decision-making assets, ensuring that governance frameworks enable progress rather than constrain it.

Tina brings deep expertise in the responsible adoption of Artificial Intelligence and Large Language Models, including the design of controls to manage risk, bias, and ethical use. Her experience includes introducing AI model cards and transparency standards within the charity sector, alongside advanced analytical approaches such as knowledge graphs to support predictive insight.

Her leadership experience includes delivering significant financial and risk outcomes within highly regulated environments. Tina has led initiatives that reduced enterprise-wide data spend by more than £5m over five years, redesigned onboarding processes to deliver £1m in annual savings while maintaining compliance, and supported industry-leading customer services by balancing fraud mitigation with customer experience. At HSBC, she played a critical role in protecting the organisation from multi-billion-dollar regulatory risk through global data standards, training, and governance programmes, including work directly with regulators and the US Department of Justice.

Internationally, Tina has been seconded to Bermuda and Malta to embed data quality practices, strengthen governance, and build regulatory confidence. She also designed and implemented data governance frameworks across Commercial Banking and Global Banking & Markets, embedding stewardship and accountability into business-as-usual operations. Her transformation work extends into finance and technology, including cloud migration delivering 20–40% infrastructure savings and the automation of governance processes with potential annual efficiencies of £500k–£2m.

Tina is a collaborative, principled, and forward-thinking leader. She combines strategic clarity with practical delivery, helping organisations build resilient, ethical, and value-driven data and AI capabilities that stand up to regulatory scrutiny while enabling innovation.

Biography

Bejoy Thomas is a seasoned Integration Architect with more than 20 years of experience designing and delivering enterprise integration solutions across complex technology landscapes. His career is defined by a deep technical understanding of integration architectures and a strong focus on building solutions that are robust, scalable, and aligned to real business needs.

Bejoy is the founder of NJC Labs, a Salesforce Summit Partner specialising in MuleSoft-based integration services. Through NJC Labs, he has led the delivery of high-quality integration solutions for organisations worldwide, helping them connect systems, streamline business processes, and unlock greater value from their digital platforms. His expertise spans MuleSoft and a range of enterprise integration technologies, enabling him to architect solutions that perform reliably at scale.

More recently, Bejoy has been at the forefront of integrating MuleSoft with Salesforce Agentforce, enabling organisations to build AI-powered, intelligent customer service and automation capabilities. His work focuses on optimising enterprise connectivity, enhancing orchestration and automation, and ensuring that AI-enabled solutions are securely and effectively embedded into core business operations.

Bejoy brings a pragmatic, delivery-focused mindset to integration and automation challenges. He combines architectural rigour with hands-on experience, helping organisations maximise the return on their Salesforce and MuleSoft investments while laying the foundations for future innovation

Biography

Samir Sharma is a data and AI strategy leader focused on turning ambition and investment into measurable business results. His work centres on helping organisations move beyond strategy decks and pilots, translating data and AI initiatives into outcomes such as revenue growth, cost savings, improved products, and stronger customer experiences.

Samir has worked in data transformation since 2002. In 2012, he founded datazuum, with a clear mission: to close the gap between data and AI strategy and real-world execution. Today, he leads a team of senior associates who embed directly within client organisations, working alongside leadership and delivery teams to ensure data and AI initiatives achieve tangible, measurable impact.

A defining feature of Samir’s approach is his emphasis on execution discipline and value realisation. He has helped organisations across sectors identify and prioritise high-impact use cases, shape platform and architecture decisions, and quantify business value in terms that resonate with boards and executive teams. His experience spans both commercial and public-sector environments, where clarity of value and return on investment is critical.

Samir is also the author of The Strategy Canvas: A Field Guide for Data & AI. Closing the Strategy Execution Gap, a practical guide for leaders and practitioners on how to bridge the strategy–execution divide and turn data and AI investment into results. The book is scheduled for release in December 2025.

His work has delivered demonstrable outcomes, including identifying over $125m in potential annual value from high-impact use cases for a major US association, uncovering cost savings and revenue leakage within UK logistics operations, and supporting board-level decision-making through independent analysis of modern data platforms.

Samir brings a pragmatic, outcome-driven mindset to data and AI transformation. He combines strategic clarity with hands-on execution, helping organisations focus on what truly matters and deliver results that can be seen, measured, and sustained.

Biography

Robin Miller is a data and AI governance specialist focused on helping organisations build governance that enables progress rather than restricting it. His work centres on getting governance right in practice, ensuring organisations can innovate with data and AI while remaining secure, compliant, and trusted.

Through his work with 8GG, Robin partners with boards and senior leadership teams to reshape how governance is designed and embedded across organisations. His approach is grounded in a people-first philosophy, recognising that effective governance depends as much on culture, clarity, and capability as it does on policy and control.

Robin is known for challenging traditional, overly rigid governance models. Instead, he focuses on practical frameworks that empower teams to make better decisions with data, while maintaining appropriate safeguards around risk, privacy, and regulation. Whether supporting AI implementation, data strategy, or enterprise-wide governance design, his emphasis is on solutions that scale with the business and support long-term value creation.

At 8GG, Robin specialises in making AI governance both practical and commercially relevant, with a particular focus on language models and emerging AI technologies. He helps organisations navigate the complexity of modern AI responsibly, turning abstract governance challenges into clear, workable approaches that support innovation, resilience, and measurable business outcomes.

Robin brings a pragmatic, outcome-oriented mindset to governance. He combines strategic insight with hands-on delivery, helping organisations move beyond compliance-led thinking to governance models that actively support growth, trust, and innovation.

Biography

John Argent is an experienced leader with over 30 years spent navigating change, complexity, and continual learning within professional services environments. His career has been shaped by the understanding that mastery is never static and that progress comes from staying curious, adaptable, and open to new ways of thinking.

Throughout his work, John has consistently embraced change as an opportunity rather than a disruption. As the pace of transformation has accelerated, his approach has remained grounded in learning, reflection, and improvement, qualities that continue to define his professional outlook.

John thrives in collaborative environments and places strong value on working alongside bright, energetic, and inspiring colleagues. He believes that the greatest impact is achieved when teams combine courage, creativity, and constructive challenge, creating the conditions to deliver meaningful value for clients.

His contribution is rooted not just in experience, but in perspective. John brings calm, balance, and insight to complex situations, helping teams and clients navigate uncertainty with confidence and purpose.